Inventory Revaluation in D365FO: Scenario with Costs

Inventory Revaluation in D365FO: Scenario with Costs

Posted on: March 27, 2019 | By: Jarrod Kraemer | Microsoft Dynamics AX/365

Authored by: Dave Occhionero

Inventory revaluation is a process in AX/D365 that is commonly misunderstood. There are many scenarios and processes within D365 that impact the results of what the inventory revaluation calculates and displays. In this blog post, I wanted to document a scenario that is focused on a very specific costing scenario, with the hope that some of the fundamentals outlined below can apply to your costing setup.

The first scenario shows the revaluation impact when costing is tracked at the Batch # level.

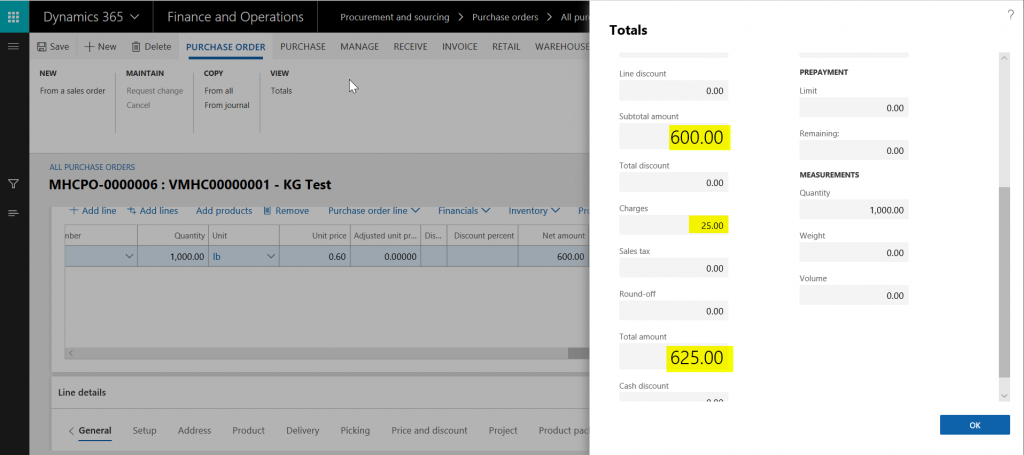

Let’s first assume that a purchase order is created with the following costs.

- The total cost of the Purchase order is $625 of which

- Material = $600

- PO Charge= $25

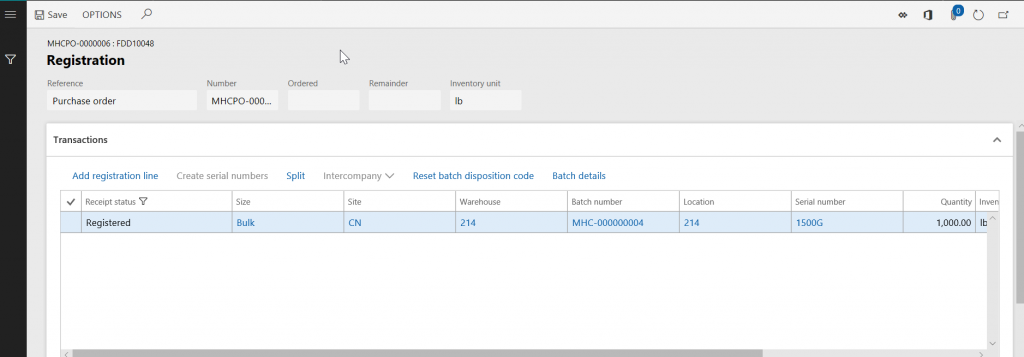

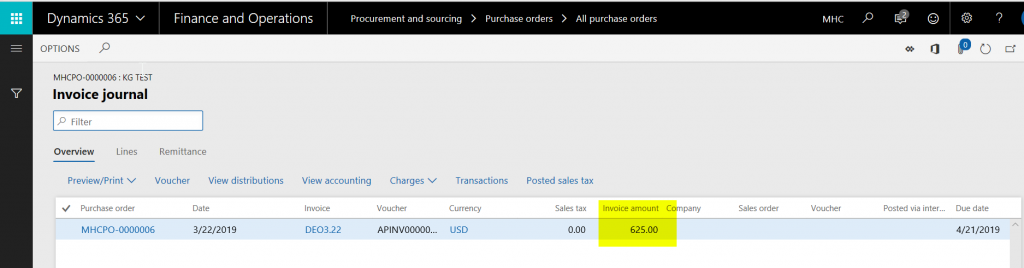

- Let’s assume that Purchase Order Registered/Received & Invoiced @ $625.

- This registered transaction creates Batch Number: MHC-000000004

- On hand inventory cost of the batch shows as $625.

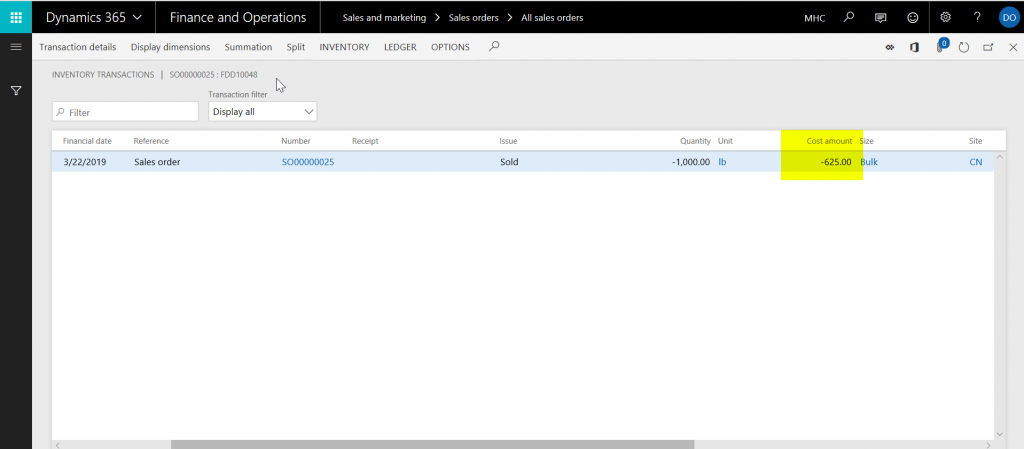

- The next step will be creating, shipping, and invoicing a sales order.

- Once the sales order has been invoiced the $625 cost amount from the batch is applied to the sales order’s inventory transaction. This will be used to calculate margin on the sales order.

This scenario is a straight forward and common business scenario. A purchase order comes in, and a sales order goes out.

To continue with this example, I want to show what happens when adding a charge to a purchase order after it has been invoiced.

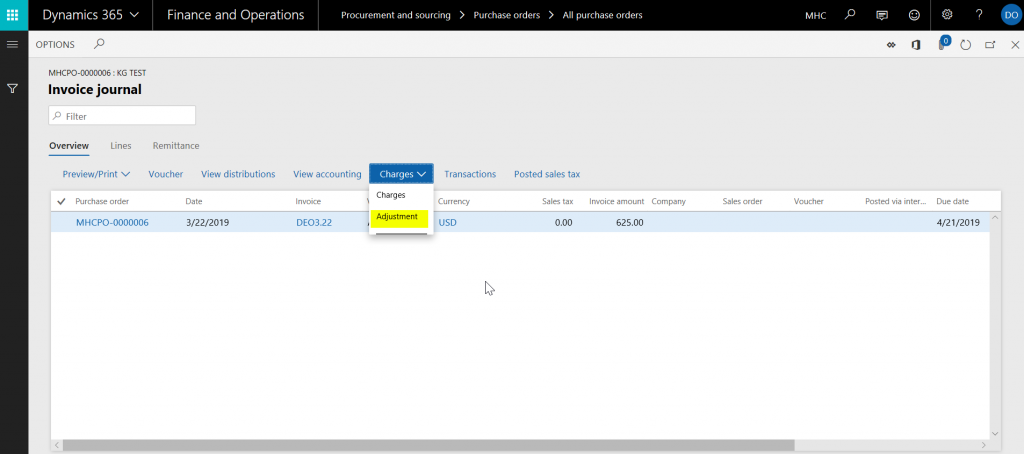

- Navigate to the invoiced purchase order from the steps listed above (MHCPO-0000006)

- Add a Purchase charge >adjustment

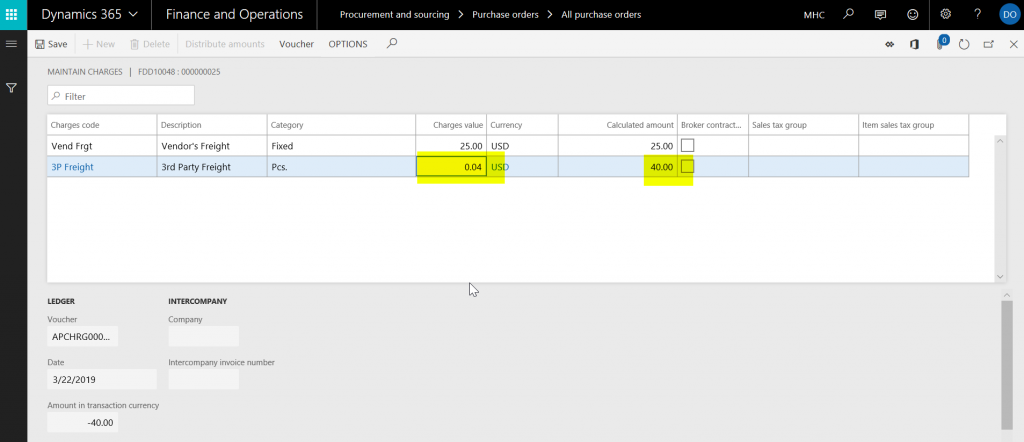

- In this example we will add a $.04/lb. charge in addition to the already created/invoiced $25. When it’s extended across the PO line quantity, it calculates as $40.

- From the above screen shot a $40 charge is now added to the purchase order

- Now that the cost has been adjusted, we will run the inventory recalculation.

- Navigate to Inventory Management >Periodic >Closing and adjustment

- Run the recalculation.

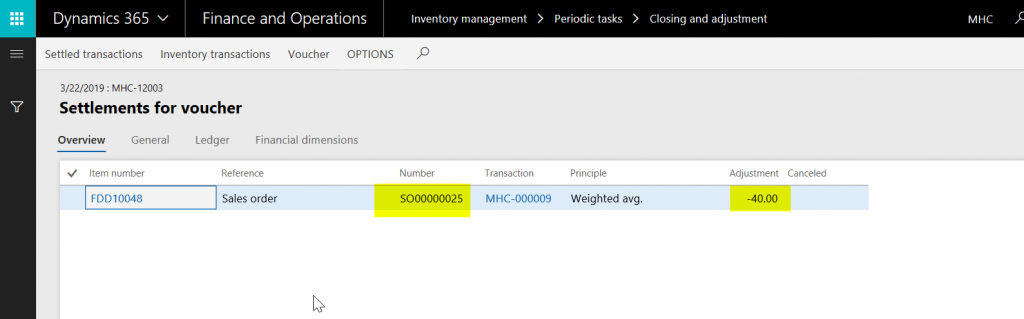

8. When the recalculation runs, a recalculation record will be created. Locate the revaluation record and click Details >Settlements

9. The adjustment from the recalculation engine displays, and the adjustment is made on the sales order that has been already invoiced.

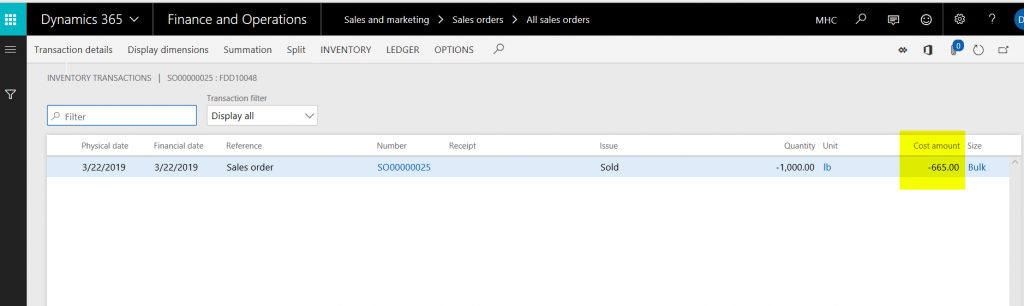

10. When looking at the transaction on the sales order, the cost has been updated from $625 to $665 following the revaluation.

Production Order

The two scenarios outlined above list out a simple purchase order to sales order process. This next section will tackle a simple production order scenario.

- Let’s make a few assumptions that the item utilized in this scenario is a product master.

- We are purchasing the item in one variant, creating a production order, which transforms it into another variant, and selling the second variant.

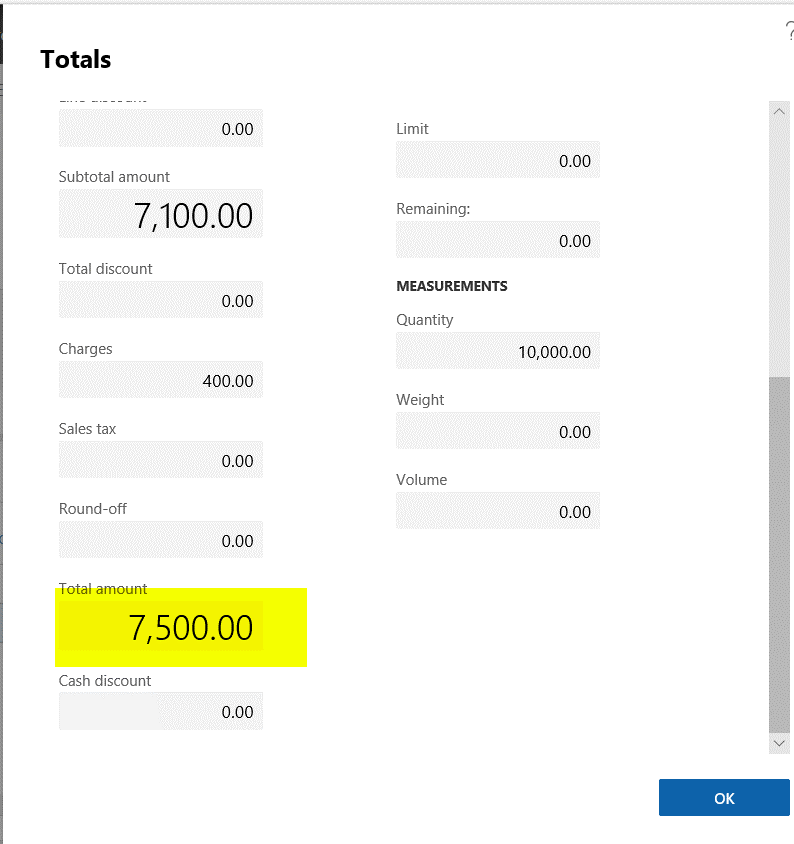

- The Purchase order is made up of the following costs:

- Material: $7100

- Freight: $400

- The purchase order has been received and invoiced. The received purchase order has a batch number created.

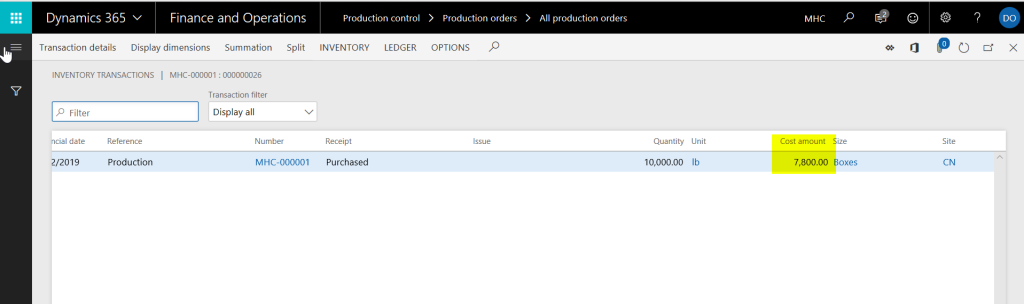

- The production order has been created started, reported as finished, and ended, and the batch that was received on the purchase order was picked as part of the BOM. The cost of the Production order (We did not add any production cost) is still showing the $7,500 (Transactions of the production order).

- Now that the production has been finished, the sales order will be shipped and invoiced.

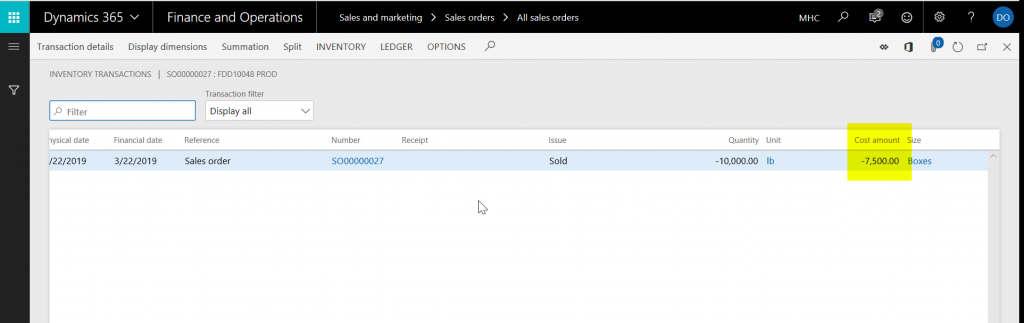

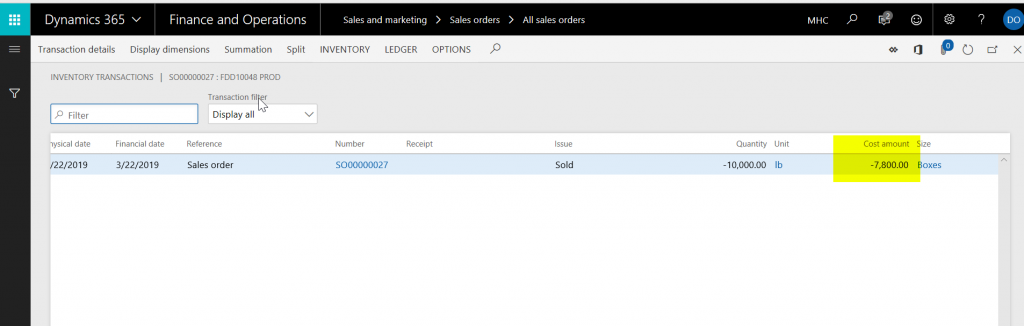

- The cost on the sales order still shows as $7,500 which is the cost of the new batch number that was created from the production order.

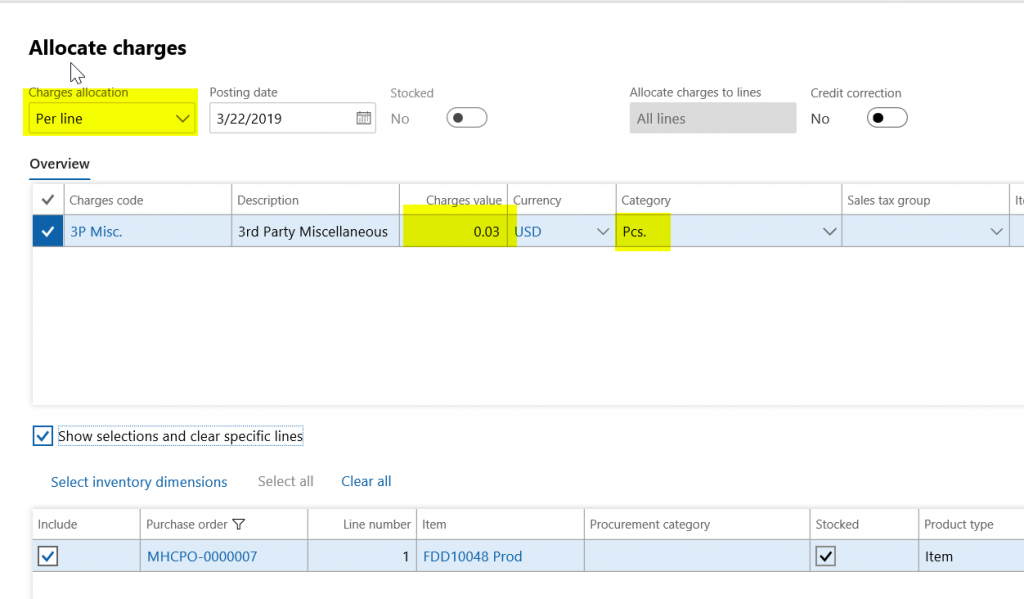

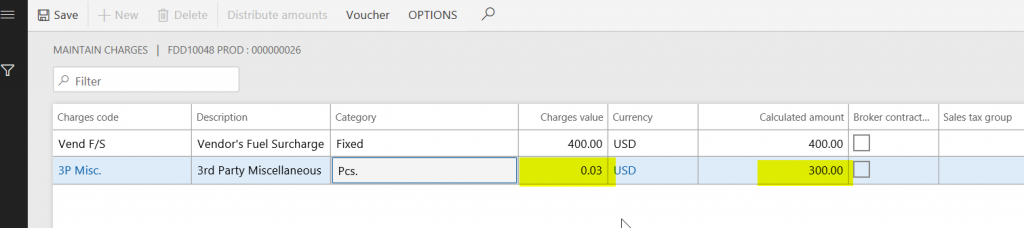

- Continuing with the same type of example in part one of this document, I will update the Purchase order with a $.03/lb. charge adjustment.

- The posted charge is shown below. When extended, it comes out to be an additional $300.

- Now we will re-run inventory recalc.

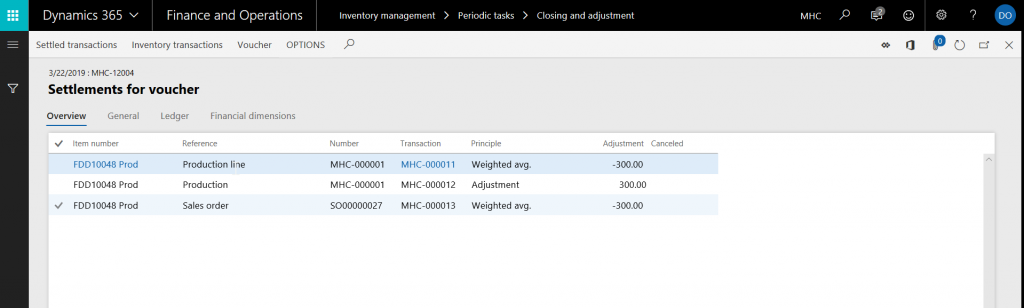

- We will view the settlements on the inventory recalculation.

- We can see that three lines have been created.

- Adjustments have posted on the Production line (input on the BOM), Production order (From the reported as finished), and the sales order.

Figure 1 Production Pick List

Figure 2 Production Transaction

Figure 3 Sales Order Transaction

This scenario shows that the inventory recalculation also flows to production orders. Inventory recalculation essentially looked at the source of the cost changes, took the receipts on the source, and identified if there were any issues tied to these receipts. I’m not technical, but I believe the system uses the LotID on the inventory transactions. The system will then look to see if there are any other receipts tied to the issues mentioned previously. In our scenario we had the receipt of the PO tied to the issue of material on the production order tied to the receipt of the material on the production order.

Although this scenario is hyper specific please feel free to reach out to us at info@loganconsulting.com or (312) 345-8817 with any other questions you may have about inventory recalculation or closing.

Comments

Post a Comment